Double Close Funding

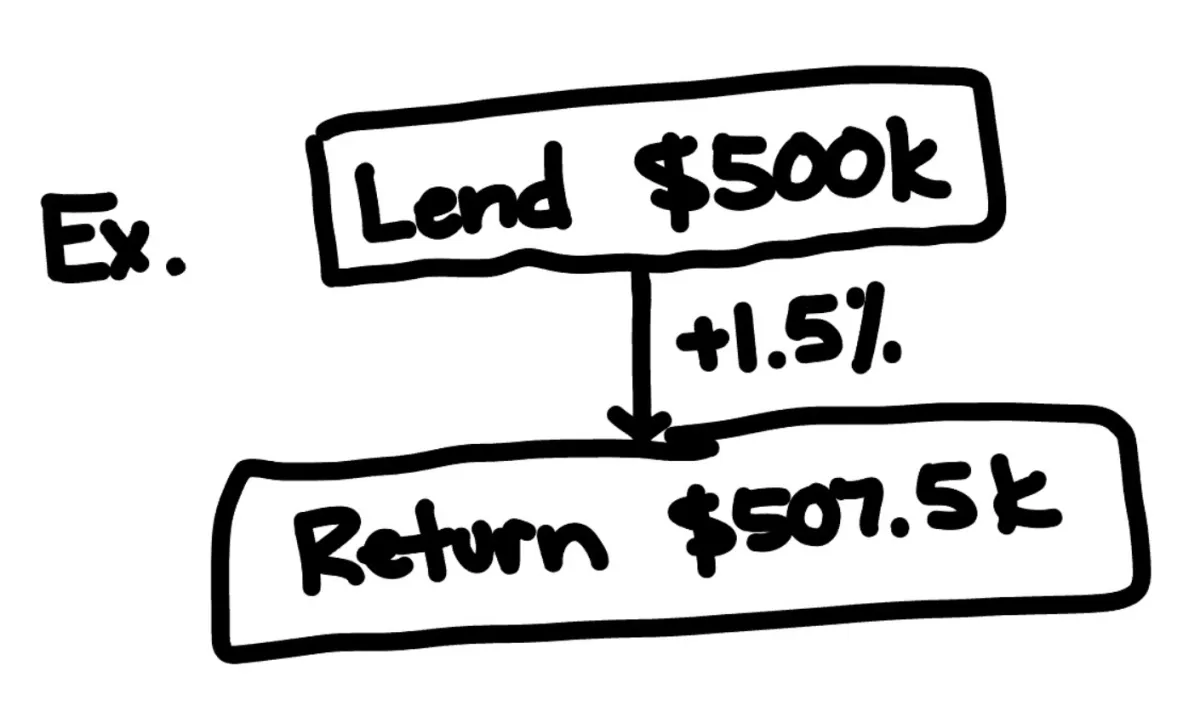

Fees starting at 1%

Close Deals Faster. Keep Your Capital Free.

Wholesalers, this one’s for you: double close funding lets you buy and sell a property on the same day without using your own cash — keeping your funds liquid and your deals running smoothly.

What is double closing?

Double close (also called transactional funding) is a short-term loan that covers the purchase of a property just long enough for you to resell it to the end buyer on the same day.

This way:

You don’t need upfront cash to secure deals

Your assignment fee stays private from the seller

You close both transactions — A to B, then B to C — without a hitch

Documents Required

To get your double close funded quickly, please provide:

A→B Contract (Purchase Contract):

The agreement where you’re buying the property from the seller (A).

B→C Contract (Resale Contract):

The agreement where you’re selling the property to your end buyer (C).

Title Company / Escrow Agent Info:

The company or agent handling the closing paperwork and funds for the transaction.

How We Work with Your Assignment Fee

Our fee (1–3% of the loan amount) is taken out of the spread — that is, the difference between your purchase price (A→B) and your resale price (B→C). You don’t pay us upfront; the cost comes from your profit at closing.

Why Fuel My Deal?

Fast Capital. Straight Answers. Real Results.

Nationwide funding up to $100 million

No credit checks

Fast approvals with minimal paperwork

Submit a Deal

Got a deal on the table? Let's get it funded.

Copyrights 2026 | Fuel My Deal. Terms and Conditions. Privacy Policy