Seller Carryback Solutions

Close Deals with Little to No Money Down

Using a hard money loan but don’t have the down payment? If the seller is willing to finance part of the purchase price, Fuel My Deal can help structure the deal and fund the gap — fast.

This is called a seller carryback, and we’ll help you make it work. Fuel My Deal offers seller carryback solutions - we provide the bridge capital to structure this kind of transaction, so your deal doesn’t fall apart at the closing table.

What is Seller Carryback?

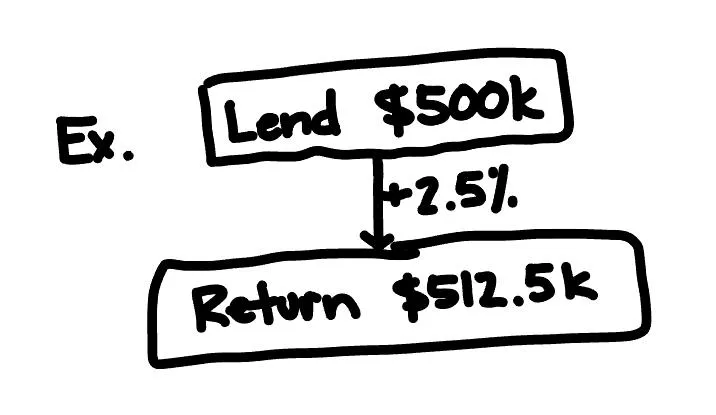

A seller carryback is when the seller agrees to "carry back" a portion of the sale price as a second-position loan — meaning you pay them back over time, instead of coming up with all the cash upfront.

It’s often used when:

The seller is motivated to help you close

Your hard money lender allows second-position financing

You need a creative way to cover the gap without using your own cash

Why use Seller Carryback funding?

Most hard money lenders will not allow the seller carryback note to be recorded unless the full down payment is shown at closing. That means even if the seller agrees to carry, you still have to bring that amount to the table first.

This is where we come in.

We fund the temporary gap, so you can close — and the seller carryback gets recorded properly.

Fees & Terms

Our fee is 3% of the loan amount, taken at closing.

Who Is This For?

Real estate investors looking for creative financing options

Buyers needing fast access to capital with flexible terms

Anyone who wants to leverage seller financing without cash flow interruptions

How it works

Negotiate terms with the seller — how much they’ll carry, repayment schedule, and interest.

Submit your purchase contract, the seller carryback agreement, and your hard money loan terms to us.

We coordinate with the lender and title to ensure everything is structured legally and cleanly.

Fuel My Deal provides the capital to show at closing.

The deal closes, and the seller carryback is recorded.

Why Fuel My Deal?

Fast Capital. Straight Answers. Real Results.

Quick and straightforward approvals

Access to capital when traditional lenders say no

Experienced team that understands your deals and needs

Submit a Deal

Got a deal on the table? Let's get it funded.

Copyrights 2026 | Fuel My Deal. Terms and Conditions. Privacy Policy